Duty drawbacks and imported intermediate inputs: Evidence from Colombia

Using Colombian data, Camilo Lopez shows that input-duty reduction leads to rises in export quantities and number of varieties. Nevertheless, the scheme allows firms to accentuate the negative impact of a customs duties increase. Only a small share of firms takes advantage of the duty exemptions and the tariff revenue leakage of the scheme is high.

About the Author: Camilo Lopez is a M2 Development Economics alumnus (Year 2019-2020). He is now Senior Economist in the Fiscal Affairs Department of Central Bank of Colombia.

Export performance can be retarded not only by existing barriers in the country of destination, but a country’s own pattern of import protection—its tariff structure which acts as a tax on its export sector— may also frustrate its goal of increasing export profits (Costinot & Werning, 2019; Tokarick, 2006). To compensate for this anti-export bias, drawbacks schemes are one of the instruments mostly used to enable exporting firms recover duties paid on imported inputs utilized in export production, while maintaining the protection on the rest of the economy.

Duty drawback schemes involve a combination of duty rebates (ex-post of exporting) and exemptions (ex-ante) and depend on each country's trade regime (Ianchovichina, 2004, 2005). In the Latin American region, as shown by Melo (2001), this type of export promoting policies have been widely employed. Countries like Colombia and Mexico have moved from the traditional reimbursement mechanism to an exemption scheme where, instead of refunding duties ex-post, an outright exemption allows exporters to avoid paying import duties in the first place.

In many countries, duty drawbacks have not been implemented successfully, largely due to administrative weaknesses (Melendez & Perry, 2010) linked with the fact that it is a relatively high-transaction cost system. Difficulty in administering and monitoring these regimes has resulted in abuse, fraud, and significant revenue leakage.

Since the 60s, the Colombian government established a system for input duty exemptions, applicable to all export sectors, which is called “Plan Vallejo” and is part of the “Special Imports/Exports Programme” (SIEP hereafter). This duty exemption covers both tariffs and value added taxes (VAT) —important source of cost for producers—, which might alleviate plausible cash and credit constraints that some manufacturing firms may have to source their foreign inputs before exporting.

Taking advantage of customs imports and exports data at firm-product-country-year level over the period 2010-2019, my master thesis paper provides direct and new empirical evidence about the duty drawback scheme in Colombia. Besides, the study provides findings of the impact of import duty rates on several firms’ export outcomes. Finally, the paper also estimates the fiscal cost or tax revenue foregone of the program.

Empirical strategy

Due to plausible endogeneity concerns, the identification strategy is based on two corrections. First, the estimates account for fixed effects at the firm-product and country-year level and controls for time varying characteristics at the industry through sector-year dummies. Second, I exploit variations both in the import duties rates — tested to be exogenous to initial sectoral performance indicators— and in the intensity (exposure) using drawback system.

The import duty rate paid by each exporting firm (Duty rate) and the intensity using the program (SIEP share) are estimated using customs database. The latter is a continuous variable from 0 to 1 that measures the degree in which the export is benefiting from the program, taking the value of 0 for non-beneficiary observations and 1 for those fully benefited. Thus, the baseline specification is a generalized difference-in-difference approach that exploits the variation and heterogeneity in imported intermediate duties combined with the intensity using the program, over time and across firms.

Eligible sample and time variant control variables

One of the main challenges to evaluate one policy that has been in place so long and that is not randomly allocated is the self-selection of firms into export promotion services. There may be non-random differences between assisted and non-assisted firms that could lead to potentially different export outcomes. To reduce this bias, the methodology ensures that the control group is similar to the treated group by guaranteeing that for each beneficiary firm, there is at least one non-beneficiary firm exporting the same product to the same market in the same year. Non-beneficiary transactions without common support in the beneficiary group are also excluded. Besides, the entire universe of exporting firms is narrowed down to those serving imports. This implies that for each firm that accesses to SIEP, there is a comparison firm that is subject to the same shocks and characteristics as the treated firm but did not participate in the programme.

Additional time variant control variables as proxies of the firm’s size and experience are included. The above follows the findings in literature regarding the positive correlation between a firm’s productivity and the number of products and countries traded (Bernard et al., 2011; Fan et al., 2015; Helpman et al., 2004; Iacovone and Javorcik, 2010; Yeaple, 2009), and previous experience as determinant of export performance (Love et al., 2016; Volpe Martincus and Carballo, 2010). Including these proxies of firm’s experience and size as covariates allow us to control for time-variant confounders that could potentially affect both usage of SIEP and export outcomes.

Results

Regarding the relevance of the “Special Imports/Exports Programme” (SIEP), I found that trade flows channeled through this regime are reasonably relevant, representing the 6.2% of Colombia's total imports, 27% of total exports, and 34% of manufacturing exports. However, the group of beneficiary firms is rather small. This may be explained by: (i) misinformation from the firms about how the scheme works and (ii) the high administrative costs of complying with the requirements more than outweigh the benefits associated with customs exemptions, which tend to decrease due to the trade agreements that have lowered tariffs.

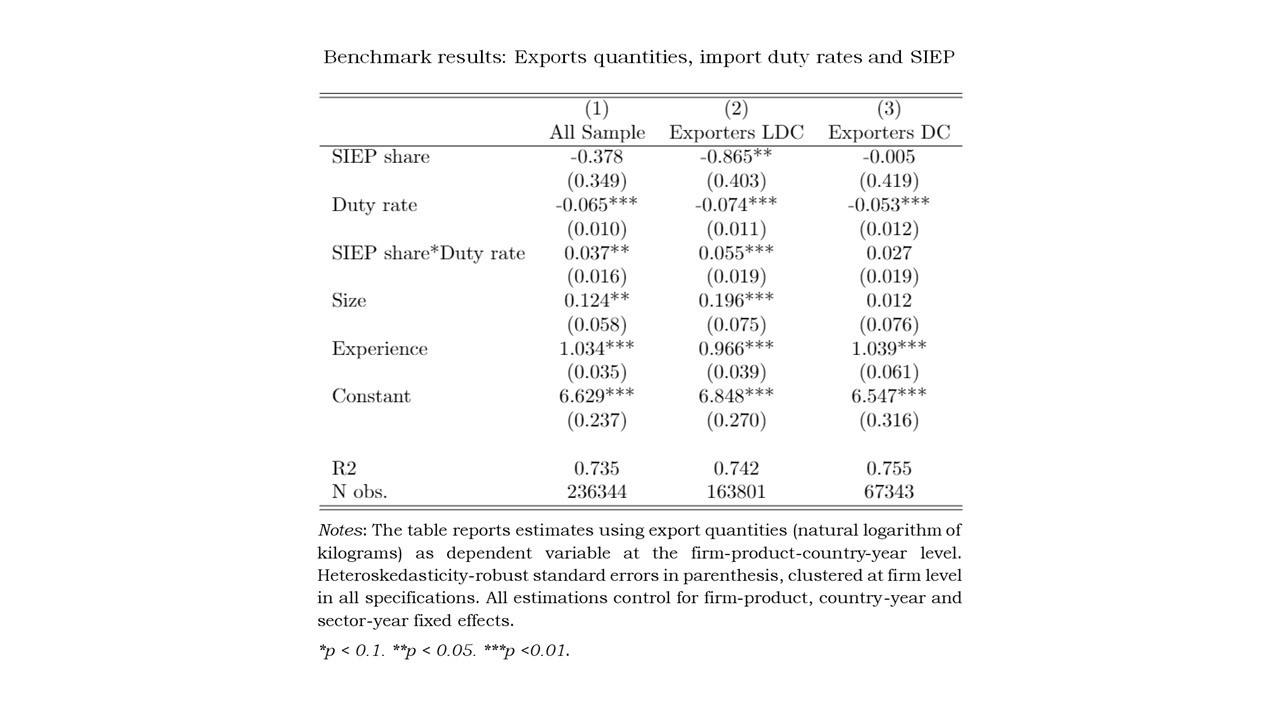

The table below shows the results of regressing firm-product-destination-time export quantities on import duty rates interacted with SIEP share. According to column 1, the Duty rate coefficient shows that the impact of import duty rate on export quantities for non-treated observations (SIEP share=0) is significantly negative. A 1 percentage point (pp) raise (decline) in the import duty rate decreases (increases) manufacturing export quantities by 6.5%. This impact is partially compensated if the export is benefiting of SIEP exemption, measured by the interaction term. For instance, assuming SIEP share equal to 1 (group most exposed to treatment), meaning that firm-product-destination-year observation is benefiting fully of the program, a 1 pp raise (fall) in import duty rate would decline (raise) export quantities by 2.8 (-0.065+0.037*1), much lower to 6.5% of non-beneficiary exports (control group).

These results suggest remarkable gains of the SIEP regime when imported intermediate inputs duty increases, since beneficiary firms are partially “shielded” from the negative effect of a tariff or VAT raise. However, if an input tariff reduction takes place, the marginal and positive impact that these reductions have on boosting exports is lower for firms that benefit from the regime.

Column (2) considers only the subsample of manufactured goods exported to low and middle-income countries (LDC), whereas column (3) focuses on products exported towards high-income countries (DC). The results suggest that the gains associated with SIEP are specific to products exported to non-high-income countries.

Other findings indicate that a reduction in the duties on imported inputs decreases export prices, which in turn raise the volume of sales. Therefore, the channels of productivity gains and/or marginal costs seem to be dominating over quality upgrading mechanism.

Last but not least, results allow me to conclude that the leakage in the tariff collection system associated with the tariffs and VAT exemptions represent around 1.73% of the GDP and 8.9% of the total taxes collected by the Government, which seems to be high in comparison with other tax revenues.

As a final point, tariffs and VAT charged on the import of goods from foreign countries have placed a significant burden on Colombian manufacturing firms. When tariffs on inputs are low, there is no reason for using tariff drawbacks; firms using resources on administrative procedures can use them to better focus on their own activities. Results indicate the importance of reducing permanently the duty applied to capital goods and raw materials not produced locally instead of using special customs regimes.